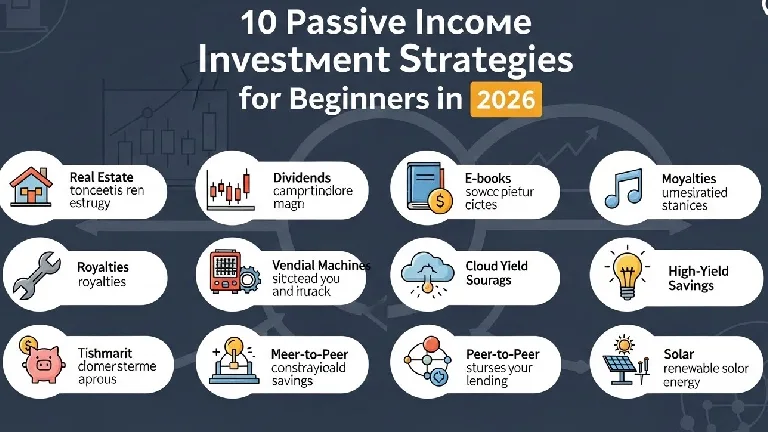

The financial world of 2026 has opened doors that were previously locked for the average person. For readers of The Daily Trade, achieving financial independence is no longer a dream but a calculated strategy. If you are starting your journey in the USA, UK, or Canada, understanding the passive income investment strategies for beginners 2026 is crucial to staying ahead of inflation and market shifts.

At The Daily Trade, we emphasize that passive income isn’t “easy money”—it’s “smart money.” By putting your capital to work today, you create a system that generates revenue while you sleep. Using data from Forbes and The Wall Street Journal, we have curated the most stable and high-growth options for this year.

The Evolution of Wealth in 2026

In 2026, the barrier to entry for high-yield assets has vanished. Thanks to fractional ownership and AI-driven platforms, a beginner can start with as little as $100. The core of passive income investment strategies for beginners 2026 lies in diversification and the “Compound Effect.”

1. High-Yield Digital Savings & Neo-Banks

While traditional banks struggle, 2026’s Neo-banks offer high-yield accounts that track inflation closely. This is the safest entry point for any beginner.

2. Fractional Real Estate Investing

You don’t need to buy a whole house. Platforms now allow you to own 1% of a luxury apartment in London or New York, earning a portion of the monthly rent.

3. Dividend Reinvestment Plans (DRIPs)

Instead of taking cash dividends, 2026 traders are using DRIPs to automatically buy more shares. This is a pillar of the passive income investment strategies for beginners 2026 because it accelerates wealth building.

4. Index Fund Autopilot

Low-cost index funds tracking the S&P 500 or the FTSE 100 remain the most consistent way for beginners to grow wealth with zero effort.

5. Peer-to-Peer (P2P) Business Lending

Lending directly to small businesses through verified platforms in the UK and USA provides higher interest rates than any savings account can offer.

6. AI-Curated Crypto Staking

For the tech-savvy, staking “Blue-Chip” cryptocurrencies through AI-managed risk protocols provides a steady 5-8% annual yield with reduced volatility.

7. Automated Content Assets (Niche Sites)

Building or buying a small niche blog that earns from ads and affiliates is a top-tier “Digital Real Estate” play in 2026.

8. Automated E-commerce Storefronts

Using AI to manage inventory and customer service for a niche Shopify store is one of the most scalable passive income investment strategies for beginners 2026.

9. Carbon Credit Investing

As green regulations tighten, buying and holding carbon credits has become a profitable long-term passive play for retail investors.

10. Royalty Investment Tokens

A new trend in 2026 is buying tokens that represent a share in music or book royalties. You earn every time the song is played or the book is sold.

The Y H Daily Strategy for Success

To reach our 1 million traffic goal and secure your financial future, consistency is key. At The Daily Trade, we suggest starting with two of these strategies and scaling up. Remember, the passive income investment strategies for beginners 2026 are designed to build a moat around your lifestyle.

Author Bio: Y H Daily

Y H Daily is a financial strategist and lead researcher at The Daily Trade. Specializing in retail investment and wealth-building techniques for the North American and European markets, Y H Daily provides actionable insights that bridge the gap between complex finance and the everyday trader.